Financial Management II

The MBA Financial Management II subject contains four modules namely Analysis of Financial Statements, Management of Working Capital, Inventory Management, and Receivables and Cash Management.

As a student of MBA, it is expected that you will focus your study on the following; Financial Statements, Funds Flow Statements, Cash Flow Statements, Operations Cash Flow, and uses of the Statements, Ratio Analysis.

In module two, you’ll learn the concept of working capital, Liquidity Management, Determination and estimation of working capital. The third module will explore inventory management, inventory system and different analysis. The last module covers receivable management, cash management, credit policy and cash investment.

As a student of MBA, it is expected that you will focus your study on the following; Financial Statements, Funds Flow Statements, Cash Flow Statements, Operations Cash Flow, and uses of the Statements, Ratio Analysis.

In module two, you’ll learn the concept of working capital, Liquidity Management, Determination and estimation of working capital. The third module will explore inventory management, inventory system and different analysis. The last module covers receivable management, cash management, credit policy and cash investment.

Module I: Analysis of Financial Statements

This module covers the following topics; Financial Statements, Changes in financial position, Changes in working capital, Funds flow statement, Uses the statement of changes in Financial position, Cash flow statement, Cash flow from operating, Investing and financing activities, Nature of Ratio analysis, Utility of Ratio analysis, and Types of Ratios (Liquidity, Leverage, Activity and Profitability ratios).

Module II: Working Capital Management

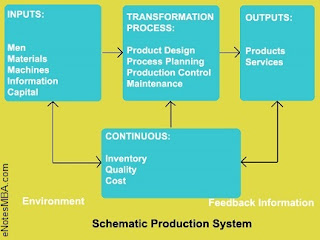

This module deals with the Concepts of working capital, Focus on current asset and liquidity Management, Operating and cash conversion cycle, Permanent and variable working capital, Dangers of excessive and inadequate working capital, balanced working capital, Determinants of working capital, Issues in working capital requirement, Estimating working capital needs, and Policies for financing current assets.

Module III: Inventory Management

This module explores the inventory management introduction, Nature of Inventories, Need to hold inventories, Objectives of Inventory Management, costs associated with inventory management, Assumptions of EOQ Model, Reorder Point, Safety stock, Inventory Control Systems, and ABC analysis.

Module IV: Receivables and Cash Management

This module covers the Objectives of Receivables Management, Cost Consideration with

investment in receivables, Components of Credit Policy, Monitoring the receivables and concept of factoring. Motives for holding cash, Objectives of Cash Management, Baumol Model for determining optional cash, cash collection instruments, investment opportunities of surplus cash.