PPT - Indian Financial System

Financial System

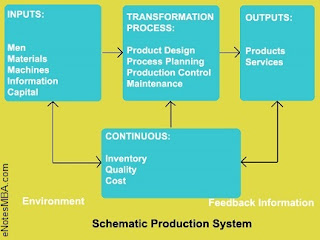

Financial System is a mechanism that works for investors and people who want finance. Financial system is an interaction of various intermediaries, market instruments, policy makers, and various regulations to aid the flow of savings from savers to investors and managing the proper functioning of the system.

Financial System is a mechanism that works for investors and people who want finance. Financial system is an interaction of various intermediaries, market instruments, policy makers, and various regulations to aid the flow of savings from savers to investors and managing the proper functioning of the system.

According to Gurusamy Financial System is "a set of complex and closely interconnected financial institutions, markets, instruments, services, practises, and transactions."

PPT - Indian Financial System

Indian Financial System - Transcript

Slide 1. Indian Financial System by eNotesMBA

Slide 2. Objective of this PPT To understand the working and organization of Indian Financial System.

Slide 3. Introduction to Financial System

- Financial system is a mechanism that works for investors and people who want finance.

- It is an interaction of various intermediaries, market instruments, policy makers, and various regulations to aid the flow of savings from savers to investors and managing the proper functioning of the system.

Slide 5. Indian Financial System

Pre-planned period

- Close character of entrepreneurship

- Absence of financial intermediaries

- Low industrial growth rate.

Mixed economy based planned period

- Public/Govt. ownership of financial institutions - RBI, Nationalized banks, Special purpose financial institutions

- Investors' protection - Companies act, Securities contract act

Slide 6. Money Market Meaning

- Prof Sayers- money market is that area of market that deals in short term capital.

- Market for funds and assets that are close substitutes for money

- Focuses on providing means by which government and institutions are able to rapidly adjust their actual liquidity position.

Slide 7. Instruments of Money Market

- Call money instruments- one day loan

- Treasury bills- meeting short term deficits of govt.

- Commercial papers- short term instruments issued by corporate- introduced in Jan 1990

- Certificate of deposits- issues by banks to the depositor, introduced in June 989- lowest period 15 days for 5 lakhs

- Repo transactions- maturity of 1 day to six months

- Money market mutual funds-introduced by RBI in April 1992 and regulated by SEBI

Slide 8. Capital Market Meaning

Market where long term and medium term financial instruments are traded.

This market consists of two parts:

- Primary market

- By prospectus

- Offer for sale

- Private placement

- Right issue

- Right issue

- Employees stock option

- Sweat equity

- Secondary Market

- Located at a fixed place

- Securities of listed companies are traded

- Purpose is to transfer ownership

Slide 9. Instruments of Capital Market

- Equity shares

- Preference shares

- Debentures/ bonds

- Innovative debt instruments - Convertible debentures/bonds, Warrants, Zero interest bond, Secured premium notes, Floating rate bond

Slide 10. Instruments of Capital Market Cont.

Slide 11. Financial Intermediaries

- Forward contract - Not standardized, regulated through trading, margin is required

- Futures - Standardized , traded at over the counter market, involves counter party risk

Slide 11. Financial Intermediaries

- Banking - RBI, Commercial banks, Co-operative banks, Post office savings banks

- Non-banking - LIC, GIC, UTI, Housing development finance companies-HDFC, HUDCO

- Developmental - ICICI, IDBI, IFCI, NABARD, SIDBI, Tourism finance corporation SFCs

- Regulatory Institutions - SEBI, RBI, IRDA- insurance regulatory and development authority, Board of regulatory and development authority-BIFR