Golden Rules of Accounting - Double Entry System in Accounting

Double Entry System in Accounting

The double-entry system of book-keeping is an accounting system that recognizes the fact that every transaction has two aspects – the receiving aspect and the giving aspect, and both these aspects are recorded in the books of accounts. Or we can say, in order to receive some value, an equal value needs to be given.Let us understand this with an example:

Suppose, you are a shop owner and you are buying furniture for your shop by paying Rs 20,000 in cash.

There are two aspects involved in this transaction: You are receiving furniture which can be termed as receiving aspect. The second one, you are paying cash which can be termed as giving aspect.

According to the double-entry book-keeping system, every transaction will have at least two accounts that are impacted. A debit entry is done in one account and a credit entry is done in another account. In the above example, furniture is one account that is debited by Rs 20000 and cash is the other account that is credited by Rs 20000.

According to J.R. Batliboi “Every business transaction has two fold effect and it affects two accounts. In order to keep a complete record of transactions, one account is bound to be debited and the other account is bound to be credited. Recording this two fold account of each transaction is called Double Entry System”.

In short, we can say:

- The double-entry system records two aspects of every transaction.

- One aspect is debited and the other aspect is credited.

- The total of debits is equal to the total of credits.

The double entry system can be well explained by the Accounting equation.

What is Accounting Equation?

An accounting equation is a statement of equality. Here, the resources are equal to the sources. The owner or proprietor and outsiders provide the sources for acquiring resources. The resources are known as ‘Assets’. As owners and outsiders have provided the funds to the business and business is independent of these persons, due to the business entity concept, these persons have a claim against the assets of the business. These claims are known as ‘Equities’. Equities are of two types. They are owner’s equity and outsider’s equity. Owner’s equity (or capital) is the claim of owners against the assets of the business. Outsider’s equity (or liabilities) is the claim of the outsiders such as creditors, loan providers, and debenture-holders against the assets of the company.Resources (Assets) = Sources of Finance (Capital + Liabilities)

Someone, either owner or outsider, has a claim against the assets of the business. So, the total value of the assets is equal to the total value of capital and liabilities. The owner’s share is what is left out of the assets, after paying off all the liabilities of the outsiders.

We can say

Assets = Equity (Total claims)

Assets = Owner’s claim + Outsiders’ claim

Assets = Capital + Liabilities

This is known as the accounting equation or balance sheet equation.

The term ‘Assets’ denotes the resources owned by the business, while the term ‘Equities’ denotes the various claims of the parties against those Assets.

The assets are equal to the sum of the owner’s claim and outsiders’ claims.

Therefore, Capital = Total Assets – Outside Liabilities

Let us understand double entry and accounting equation with some examples:

Example 1 - Suppose, Meera & Co starts a business with Rs. 1,00,000 as capital. The accounting equation will be as follows:

Assets = Capital + Liabilities

Cash (1,00,000) = Capital (1,00,000) + Liabilities (0)

1,00,000 = 1,00,000

Example 2 - The business purchases furniture for Rs. 10,000. In place of cash, furniture has come into the business. The accounting equation will be as follows:

Cash (90,000) + Furniture (10,000) = Capital (1,00,000) + Liabilities (0)

1,00,000 = 1,00,000

Example 3 - At this stage, the firm makes a cash purchase of stock Rs. 20,000 for carrying on the business. The equation will be as follows:

Cash (70,000)+ Furniture (10,000) + Goods (20,000) = Capital (1,00,000) + Liabilities (0)

1,00,000 = 1,00,000

Example 4 - To add stock to the business, a credit purchase of goods is made for Rs. 30,000 from Ria & Co, who would be a creditor as he has supplied goods on credit. The equation, now, would be:

Cash (70,000) + Furniture (10,000) + Goods (50,000) = Capital (1,00,000) + Creditors (30,000)

1,30,000 = 1,30,000

Example 5 - Goods are sold on credit for Rs. 5,000. The cost of the goods is Rs. 4,000. So, the stock of goods decreases by Rs. 4,000 and debtors increase by Rs. 5,000. Here, the transaction has resulted in a profit of Rs. 1,000. This profit increases capital as the profit belongs to the proprietor as he has assumed the risk of commencing the business. So, the capital increases by Rs. 1,000. In other words, profit or loss is transferred to the capital account. Profit increases capital account while loss or drawings reduce the balance in the capital account.

Cash (70,000) + Furniture (10,000) + Goods (46,000) + Debtors (5,000) = Capital (1,01,000) + Creditors (30,000)

1,31,000 = 1,31,000

Example 6 - The business pays Rs. 200 for rent and Rs. 600 for salaries. The cash balance would be reduced by Rs. 800. So, these expenses reduce the profit and inconsequence, balance in the capital account. Now the equation will be as follows:

Cash (69,200) + Furniture (10,000) + Goods (46,000) + Debtors (5,000) = Capital (1,00,200) + Creditors (30,000)

1,30,200 = 1,30,200

From the above examples, two things are clear:

1) At any stage, the total of assets will be equal to the total of liabilities and capital.

2) An increase in an asset can result in a corresponding decrease in another asset or a corresponding increase of liability. Similarly, a decrease in an asset can result in an increase of another asset or a decrease in liability.

I believe, the double-entry system and the accounting equation are clear now. Let’s move to Rules of Debit and Credit, i.e. Golden Rules of Accounting

Golden Rules of Accounting (Rules of Debit and Credit)

Under the double-entry system of accounting, each account has two sides - the debit side and the credit side. The left hand of an account is called the debit side and the right-hand side is called the credit side. If an amount is to be debited, it is to be entered on the left-hand side of the account, while the credit amount is to be entered on the right side of the account.

Before understanding the Rules of Debit and Credit, we need to first understand the classification of accounts or the types of accounts.

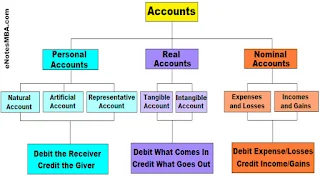

Classification of Accounts

Personal Accounts

They are the accounts of persons with whom the business deals, it can be related to Individuals like – Adam A/c, Ram A/c, Kumar A/c, Alina A/c, etc.; and related to firms, or Organizations like – your school or college say CCS A/c, DPS A/c, IPS A/c, IIM A/c; it can be related to a bank say SBI Ltd A/c, ICICI Bank Ltd A/c, or accounts that represent a certain person or a group of persons like Prepaid Rent A/c (representing landlord), or Outstanding Salary A/c (representing a group of employees)Personal Accounts are of three types:

Natural Personal Accounts: Natural Persons are human beings. Therefore, we include the accounts belonging to them under this head. For instance, Debtors, Creditors, Capital A/c, Drawings A/c, etc.

Artificial Personal Accounts: Artificial persons are not human beings but can act and work like humans. They have a separate identity in the eyes of law and are capable to enter into agreements. These include H.U.F, partnership firms, insurance companies, co-operative societies, companies, municipal corporations, hospitals, banks, government bodies, etc. For example, Bank of Baroda, Oriental Insurance Co,.

Representative Personal Accounts: These accounts represent the accounts of natural or artificial persons. When the expenses become outstanding or pre-paid and incomes become accrued or unearned, they fall under this category. For example, Outstanding Salary A/c, Pre-paid Rent A/c, Accrued Interest A/c, Unearned Brokerage A/c, etc

Real Accounts

These are the accounts of all the assets of the organization. We do not close these accounts at the end of the accounting year and appear in the Balance Sheet. Thus, we carry forward the balances of these accounts to the next accounting year. Therefore, we can also say that these are permanent accounts. We can further classify these into:Tangible Real Account: It consists of assets, properties or possessions that can be touched, seen, and measured. For example, Plant A/c, Furniture, and Fixtures A/c, Cash A/c, etc

It is important to note that bank account is a personal account, not a real account. Many think cash and bank represent property and the purpose of holding is the same so they think bank account is also a real account. Balance lying in SBI is to be distinguished from the balance in ICICI. Bank balance is related to the institution where it is kept. Cash is a real account, while a bank account is a personal account.

Intangible Real Account: It consists of assets or possessions that cannot be touched, seen, and measured but possess a monetary value and thus can be purchased and sold also. For example, Goodwill, Patents, Copyrights, etc.

Nominal Accounts

Nominal Accounts are the accounts relating to the expenses, losses, incomes, and gains, like- rent, rates, lighting, insurance, salaries, dividends, etc. These are temporary accounts and thus we need to transfer their balances to Trading and Profit and Loss A/c at the end of the accounting year. Therefore, these accounts have no balance to be carried forward next year as they are closed.A question is asked many times in examinations. How a nominal account becomes a personal account?

When prefix or suffix is added to a nominal account, it becomes a personal account. For example – Rent A/c is a nominal A/c, but Outstanding Rent A/c or Rent Prepaid A/c is Personal Account.

Similar is the case with salary a/c, interest a/c, or insurance a/c. they all are nominal accounts, but outstanding salaries a/c, outstanding interest a/c, or outstanding insurance a/c are personal accounts.

Golden Rules of Accounting

Golden Rules of Accounting are also known as the “Traditional Rules of Accounting” or “Rules of Debit and Credit”. Three golden rules of accounting are used to prepare an accurate journal entry which forms the very basis of accounting and acts as a cornerstone for all bookkeeping. The rules of accounting are set differently for the different types of accounts discussed above.Rule 1: Debit the Receiver, Credit the Giver

This rule is applicable to personal accounts. Transactions related to persons – natural, artificial, or representative person are recorded following Rule 1 - Debit the receiver, and Credit the giver. Debit the person’s account when a person received something from the business and Credit the person’s account when a person gives something to the business.

Example 1 – Cash Paid to Kumar Rs 50000

Here, Kumar is the receiver of Rs 50000, and according to the rule the receiver is debited, so Kumar A/c should be debited by Rs 50000, and cash is going out of the business, so Cash A/c should be credited by rs 50000.

Example 2 – Cash received from Alina Rs 25000

Here, Alina is the giver of Rs 25000, and according to the rule the giver is credited, so Alina A/c should be credited by Rs 25000, and Cash is coming into the business so Cash A/c should be debited by Rs. 25000.

Rule 2: Debit what comes in, Credit what goes out

This rule is applicable to real accounts. Transactions related to the assets – tangible, or intangible assets are recorded following Rule 2 – Debit what comes in, and Credit what goes out. Debit the asset’s account when an asset comes into the business and credit the asset’s account when an asset goes out from the business.

Example 3 – Sold machinery of Rs 100000

Here, Machinery sold is going out from the business, and according to the rule any asset that goes out is credited, so Machinery A/c should be credited by Rs 100000, and in return for it the business is getting cash or cash is coming into the business, so Cash A/c should be debited by Rs 100000.

Rule 3: Debit all Expenses and Losses, Credit all Incomes and Gains

This rule is applicable to nominal accounts. Transactions related to expenses/losses and incomes/gains are recorded following Rule 3 – Debit all expenses and losses, and credit all incomes and gains. Debit the Expense’s/losses account when a business incurred some expense or loss and Credit the Income’s/gain’s account when a business earned income or get gains.

Example 4 – Rent paid of Rs 20000

Here, Rent is an expense for the business, and according to the rule any expense or loss is debited, so Rent A/c should be debited by Rs 20000. Cash is going out from the business, so Cash A/c should be credited by Rs 20000.

Example 5 – Interest received of Rs 2000

Here, interest received is an income for the business, and according to the rule any income or profit is credited, so Interest A/c should be credited by Rs 2000. Cash is coming into the business, so Cash A/c should be debited by Rs 2000.